Second Quarter 2024 Market Talk

U.S. stock markets continued their ascent in the latest quarter with the S&P 500 now up 15.3% year to date. The tech heavy NASDAQ was up 18.1%, while the Dow was up only 4.8%. Small cap stocks were up only 1.7% as they continued their decade long underperformance.

As was the case in 2023, returns have been led primarily by large cap growth stocks.

Year to Date Returns by Size & Style

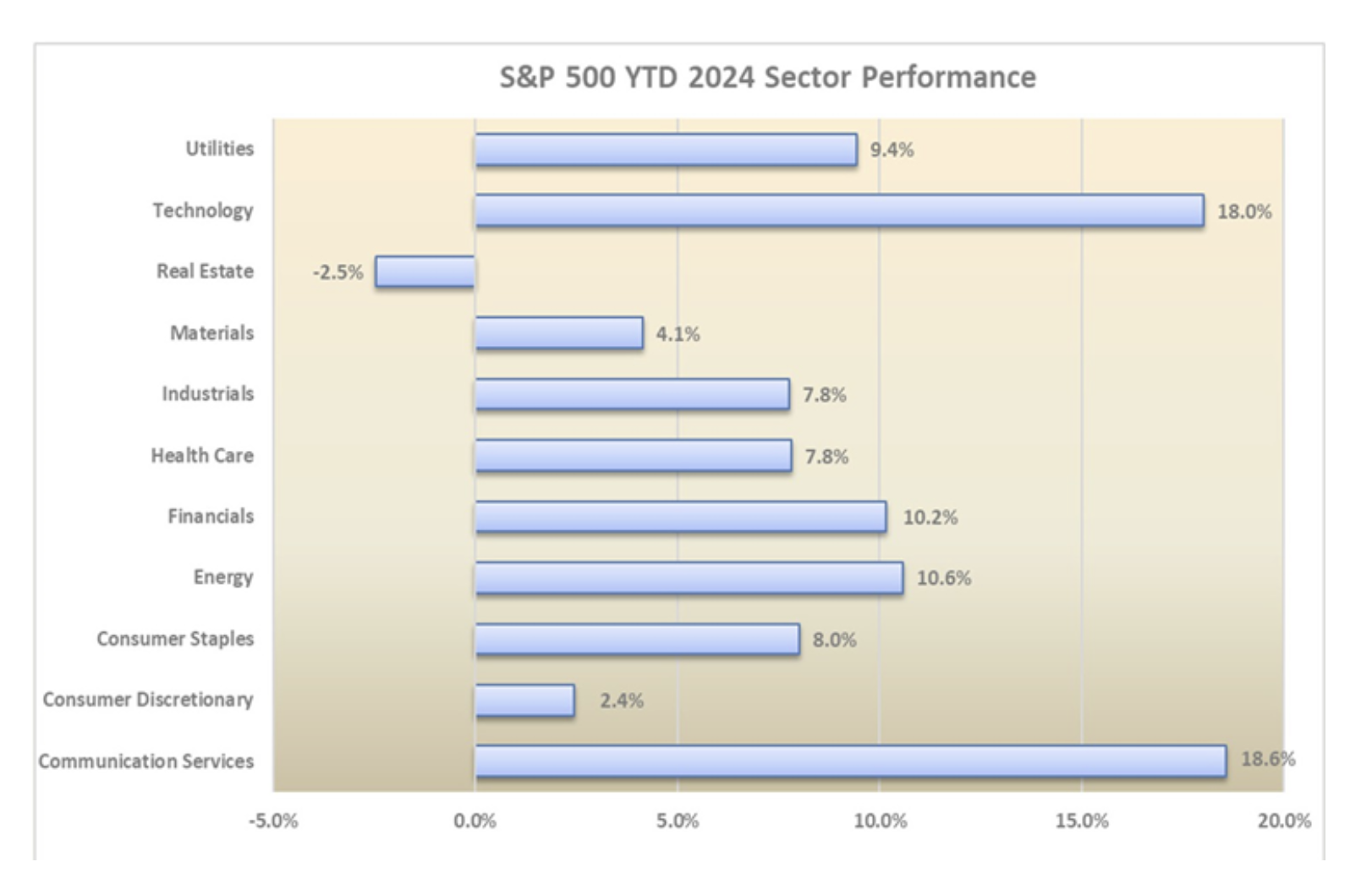

Much of these growth stocks were in the technology and communications services sectors which had returns of 18%+.

When will the rest of the market catch up to the largest growth stocks that are currently driving the majority of returns in the market? Forecasts for what they are worth, indicate that corporate earnings will broaden in the latter half of the year, potentially increasing breadth in the market. We shall find out if that is true in the next several months.

Bonds continued to waver in the latest quarter as the Bloomberg Aggregate (a broad index of treasuries, mortgages, and investment grade corporates) is down -0.7% so far this year, as yields have risen this year (bond prices move inversely to yields). The 10-year Treasury yield continues to waver, starting the year at 3.95%, going as high as 4.7% and ending the first half at 4.34%. The yield curve has been inverted (shorter term bonds yield more than long term bonds) for the longest period in history. An inversion is often a precursor to a recession, although we have not seen any evidence of a recession in the economic data.

The best returns in the treasury market have been on the short end of the yield curve where treasury bills maturing in a year or less are providing yields greater than 5%. On the corporate side, bank loan notes are leading year to date with a nearly 9% return.